Why Most People Are Financially Illiterate

- Shanyron Bell

- Mar 25, 2024

- 3 min read

Studies have shown that only between 5% and 30% of individuals are financially literate. but who cares ?

after a hard week at work, The last thing most people want to spend there weekend on is studying financial and economic concepts. Unfortunately if you want to invest in stocks long term and actually build a portfolio that will generate you returns for the rest of your life you need to have a good understanding of basic understanding of how the world works from the viewpoint of economics and finance as these are essentially the driving forces of the world we live in today.

Why is financial literacy important ?

Financial literacy does not directly translate to financial success, You can probably list of the name of 10 celebrities who do not know what an inverted yield curve is and what it means but who are financially successful.

These are probably people who created wealth through building and monetizing a following, which is a path for creating wealth that doesn't require an individual to be financially literate.

However if you want to invest at a high level, Im speaking about having millions of assets under management in stocks you need to have atleast a basic but firm understanding of finance and economics. If you don't, chances are you wont survive in this game. You may get lucky a couple of times but getting lucky in investing doesn't lead to long term survival or prosperity.

The two mistakes you want to avoid at all cost in trading and investing is:

Not trading or investing with enough capital

Not fully understanding what you are doing, why you are doing it and the potential risks involved

Financial literacy is important when analysing any stock, company or currency in depth and it will help you improve your ability to correctly estimate the future performance of a stock.

When you are investing, The most important thing is your analysis of the stock.

A stock is not just its ticker symbol with an number next to it. it is ownership in a company or business.

Financially literacy also effects how individuals invest. Who or what individuals invest in, Why individuals invest, Where individuals invest. These things are the components of how people invest.

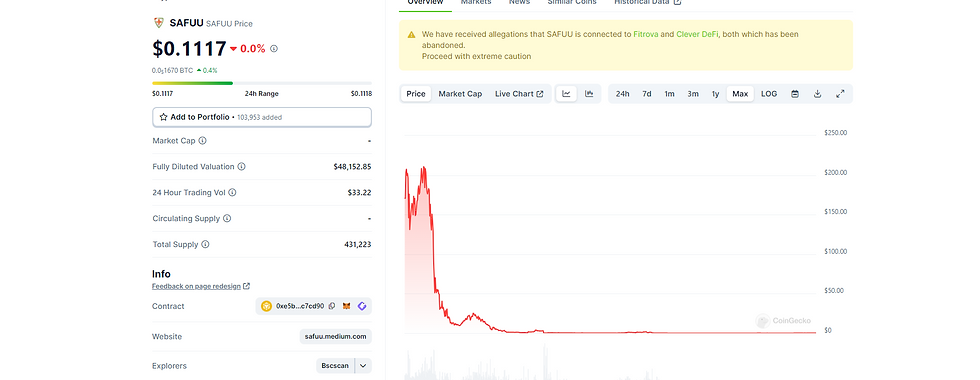

People who have a lesser understanding of economics and finance tend to fall victim to more obvious scams and fraud. A good example is the Safuuu Crypto coin which promises 300,000% returns to investors. Now most people reading this will understand that that return is basically impossible to promise. Regardless more than 100,000 people invested.

Now why would people invest in an obvious scam ? One reason is desperation. If you are an a tough financial position and feel at a loss in life with no good options you may feel like its worth the risk, investing in something that's way to good to be true.

I believe the main reason is a lack of understanding in how the financial system works.

I will never fault people for being where they're in life, My goal is to help as many people as I can get to somewhere better.

Once you understand how the financial system works, the basics of finance, economics you can make better plans and better decisions and get yourself into a better position. Investing and trading are just some of the vehicles you can use to get yourself there.

But as with any vehicle you need to know how to operate it lest you injure yourself.

Comments